Retirement Insights

Employer Support Can Help Employees Attain Financial Wellness

May 14, 2024

Do your employees struggle to pay off student loans or credit card debt? Are they achieving short-term financial goals, such as saving for an emergency appliance or car repair?

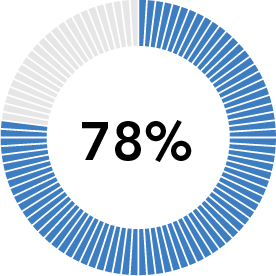

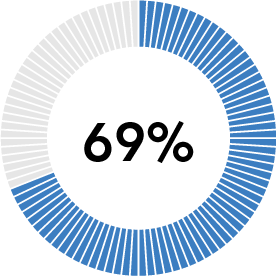

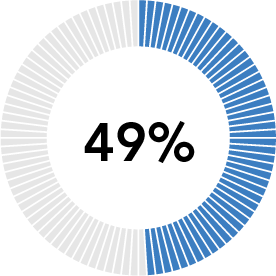

Recent financial research of American workers shows:

live paycheck

to paycheck1

have less than $1,000

in a savings account2

believe they will need to tap their

retirement plans before retirement3

Whether or not you’re surprised by these statistics, it’s important to understand that your organization also pays a price when employees are financially stressed: increased absenteeism and health care claims, as well as loss of productivity, as close to 43% of employees spend time on personal finances while at work.4

Your organization can, and should, play a significant role in helping workers achieve financial wellness and retirement readiness.

What is "retirement readiness" and how do you know if your employees have it?

More than simply saving, retirement readiness is a state in which an employee who participates in their employer-sponsored retirement plan is on target to have sufficient replacement income in retirement so they can retire on time. Most industry experts define 100% retirement readiness as the ability to replace at least 75% of projected income by age 67 through anticipated life expectancy.

Employee Financial Well-Being Matters to Your Business

Employees who are unable to reach short-term financial goals are probably not focusing on long-term financial objectives, such as retiring at their goal retirement age. Helping employees improve their retirement readiness can also mitigate the projected economic costs to your business. Through increased benefit costs, lower productivity and higher salaries, each year an employee delays retirement costs an employer more than $50,000 per employee. For a company with 500 employees, the cost is estimated at $2.25 million if only 15 workers delay retirement for three years, as reported in our article, “Is Delayed Retirement Impacting Your Bottom Line?”

Your employees may not be speaking up and requesting help, but they need a financial well-being program that does more than offer online retirement income calculators or sessions with investment specialists. A financial well-being program should help them improve their ability to live within a budget, reduce debt and save for the future.

USI Consulting Group (USICG) recommends a variety of methods, such as:

- Provide employees with more integrated, personalized and effective solutions to attain retirement goals

- Enhance retirement plan design, such as automatic enrollment and appropriate contribution rates and default investment vehicles for participants

- Ensure the plan recordkeeper is proactively meeting the plan’s needs to help your organization and plan participants reach goals

- Improve your organization’s benefits program to include retirement planning tools and resources

- Implement a financial wellness program and set a strategy to ensure employees participate — and measure the program’s effectiveness and adjust, as needed, to engage employees

A 2024 study by the National Institute on Retirement Security shows nearly 80% of Americans surveyed agree there is a retirement crisis and more than 50% are concerned they cannot achieve financial security in retirement.

In addition, Fidelity’s 2024 State of Retirement Planning study cited these barriers to reaching retirement planning goals:

![]()

Cost of living increases

![]()

Credit card debt

![]()

Unexpected expenses

![]()

Building an emergency fund

![]()

Childcare costs

![]()

College loans

Case Study: Plan design drives positive outcomes

A client engaged USICG to improve retirement plan participation and retirement readiness. Prior to hiring USICG, automatic enrollment was implemented with a default deferral rate of 2% of compensation and an automatic escalation rate of 0.5% per year. Initially, the participation rate jumped from 75% to 90.4%. However, over time, it dropped back down to 75% and the average deferral rate was 5%.

USICG recommended the client conduct a re-enrollment, where employees take a fresh look at their investment options, as well as increase the default rate and the automatic escalation rate. This increased participation to 95% and the average deferral rate to 6.32%. Only 12 plan participants opted out.

A few years after implementing these recommendations, plan participation rates remain steady, and the average deferral rate is close to 9%. This example shows how employers can increase enrollment, encourage employees to save more for retirement, and ultimately improve employees’ retirement readiness through fundamental plan design enhancements.5

How USI Consulting Group Can Help

We are committed to delivering health, wealth and investment solutions to enhance your benefit offering and help your employees better prepare for the future. To learn more, please contact your USICG representative, visit our Contact Us page or reach out to us at information@usicg.com.

1 Payroll.org, Increase in Americans Living Paycheck to Paycheck in Just One Year, 2023

2 GOBankingRates Sixth Annual Savings Survey, 2019

3 PWC, Employee Financial Wellness Survey, 2021

4 John Hancock, 2020 Financial Stress Survey

5 Actual results will vary and are dependent upon various factors including, but not limited to: number of participants, total plan asset value, management fees, administrative costs and services provided. Neither USI nor its affiliates and/or employees/agents/representatives offer investment advice to plan participants.

Investment advice provided to the Plan by USI Advisors, Inc. Under certain arrangements, securities offered to the Plan through USI Securities, Inc. Member FINRA/SIPC. Both USI Advisors, Inc. and USI Securities, Inc. are affiliates of USI Consulting Group.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend you seek independent advice specific to your situation from a qualified investment/legal/tax professional. | 1024.S0501.0034

INSIGHTS BY TOPIC

Not receiving our newsletter?

Stay up to date with retirement plan updates and insights by subscribing to our email list.